The burden of student debt in America has reached alarming levels, impacting millions of borrowers long after they graduate. With the total outstanding student loan debt in the United States surpassing $1.7 trillion, it is imperative to examine the state of student debt and understand its implications.

In this article, we will delve into the latest data provided by Federal Student Aid, a part of the U.S. Department of Education, shedding light on the magnitude of the crisis and exploring key insights through our visualizations.

Let’s explore some key highlights:

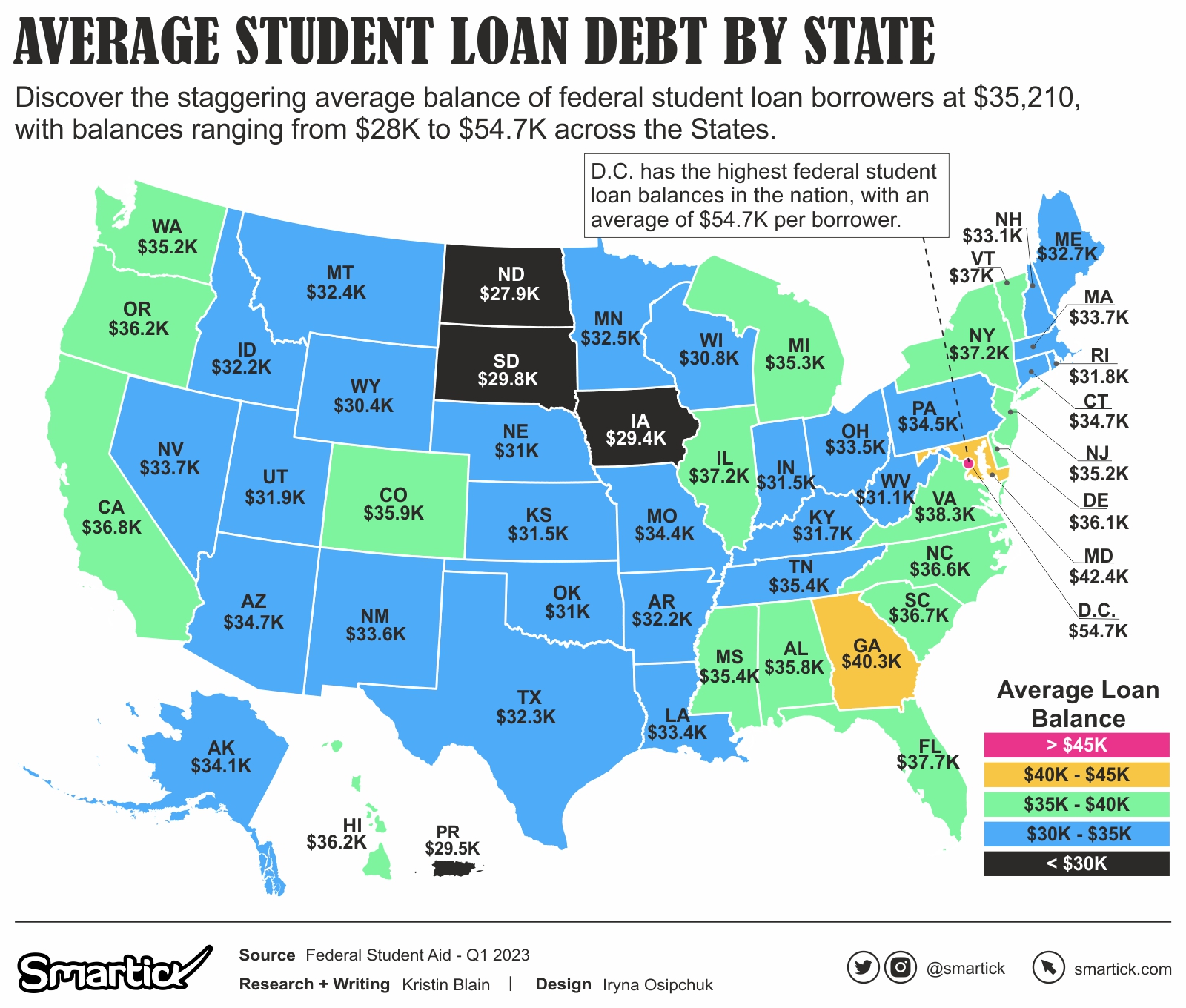

- Highest Average Debt: Washington, D.C. ranks highest in terms of average student loan debt, with borrowers in the state facing an average debt of approximately $54,708. This significant average reflects the financial challenges faced by students in the region.

- Lowest Average Debt: Conversely, North Dakota stands out as having the lowest average student loan debt among states. Borrowers in this state face an average debt of around $27,900, indicating a comparatively lower burden on students in the state.

Average Student Loan Debt by State

On a national level, the average balance for federal student loan borrowers stands at a staggering $35,210. However, it’s important to note that this average varies significantly from state to state, highlighting the disparities in educational financing across the country. The average loan balance per student spans a range from $28,000 to $54,700, showcasing the wide disparity between states. Visualizing this data reveals a complex landscape where some states bear a heavier burden of student loan debt compared to others.

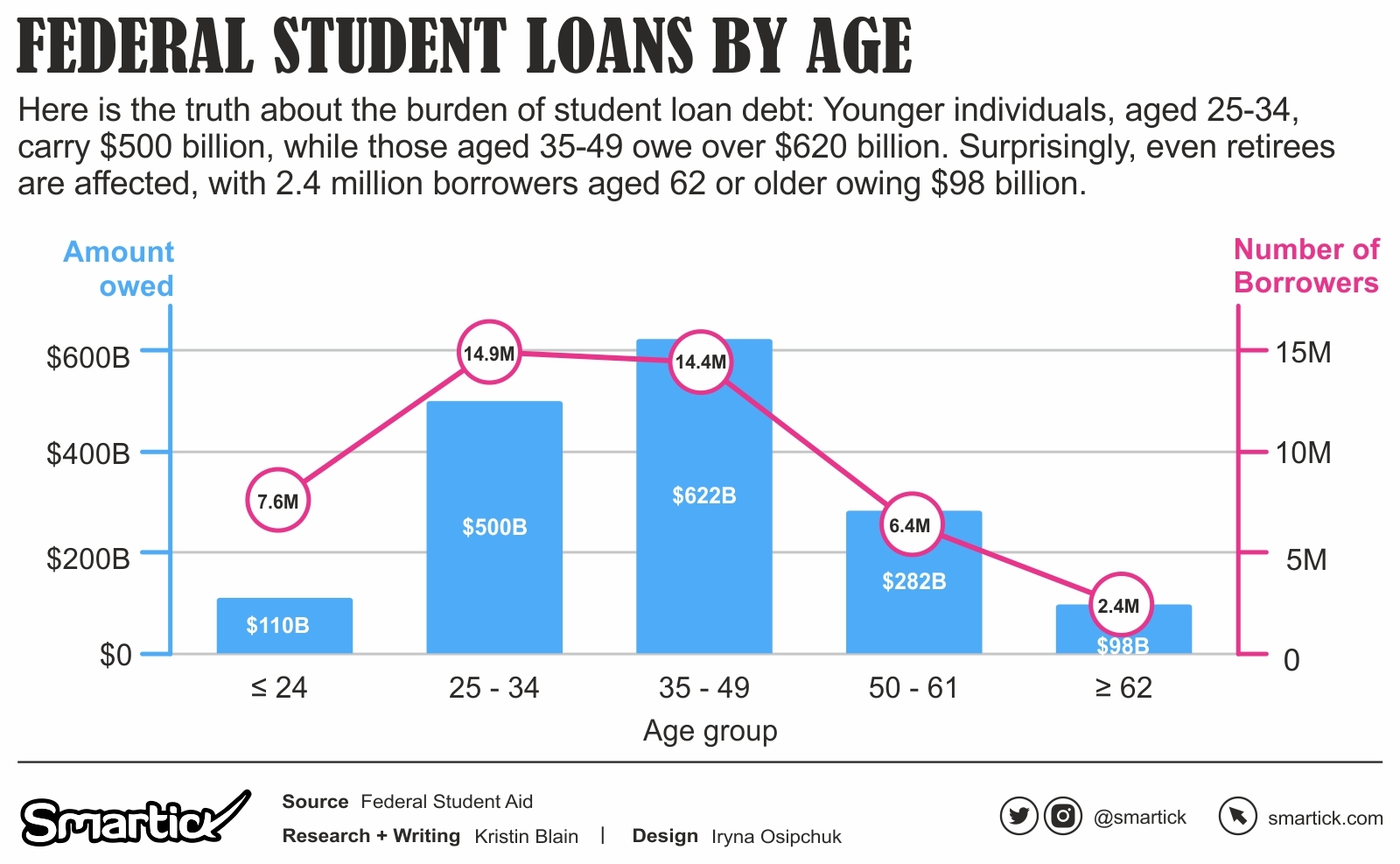

Federal Student Loans by Age

As expected, the weight of student loan debt falls primarily on younger individuals. It’s no surprise that borrowers between the ages of 25 and 34 shoulder a significant portion, amounting to a staggering $500 billion in federal student loans.

However, the impact of education debt extends well into middle-age and beyond. Individuals aged 35 to 49 find themselves owing over $620 billion in student loans.

Even retirees are not immune to the pressure of student loans. Astonishingly, there are 2.4 million borrowers aged 62 or older who still owe a substantial $98 billion in student loans. This unfortunate reality emphasizes the long-lasting repercussions of educational debt throughout one’s lifetime.

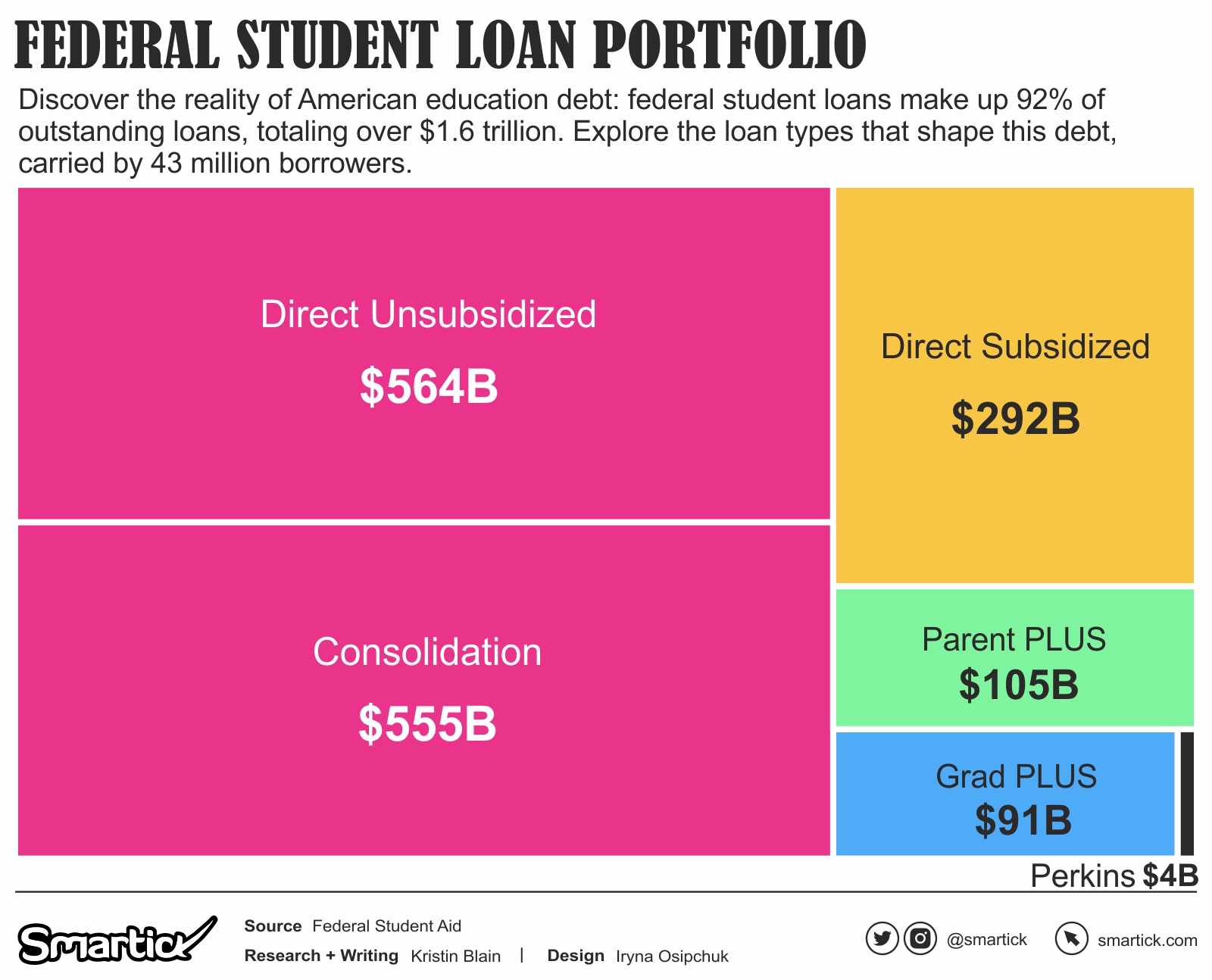

Federal Student Loan Portfolio

When it comes to American education debt, federal student loans reign supreme, constituting a whopping 92% of all outstanding student loans. The federal student loan portfolio stands tall, reaching a staggering total of over $1.6 trillion, with approximately 43 million borrowers shouldering this responsibility. Now, let’s delve into the specifics and examine how this substantial debt is distributed among various loan types.

The student debt crisis in America remains a pressing concern, with borrowers facing substantial financial challenges. By visualizing the data provided by Federal Student Aid, we can gain a deeper understanding of the regional variations, average debt levels, and age group dynamics within the student debt landscape. This understanding is crucial for policymakers and individuals alike as they work towards implementing effective solutions to alleviate the burden and foster a more sustainable system for higher education financing in the United States.